Revolut is now available in Belgium as a financial platform. Revolut offers a range of features such as:

- An online bank account for international money transfers

- Competitive currency exchange rates

- Investment opportunities on the stock market as a broker

- Crypto investments

- Travel rewards and cashback in form of RevPoints

Therefore, it is an all-in-one financial platform in theory sounds very unique and attractive for Belgians. Additionally the Revolut Credit Card Belgium allows competition on the credit card market of Belgium and allows earning RevPoints. It is possible to convert your RevPoints into miles.

Is Revolut the best credit card in Belgium? We’ll review the card in this blog post.

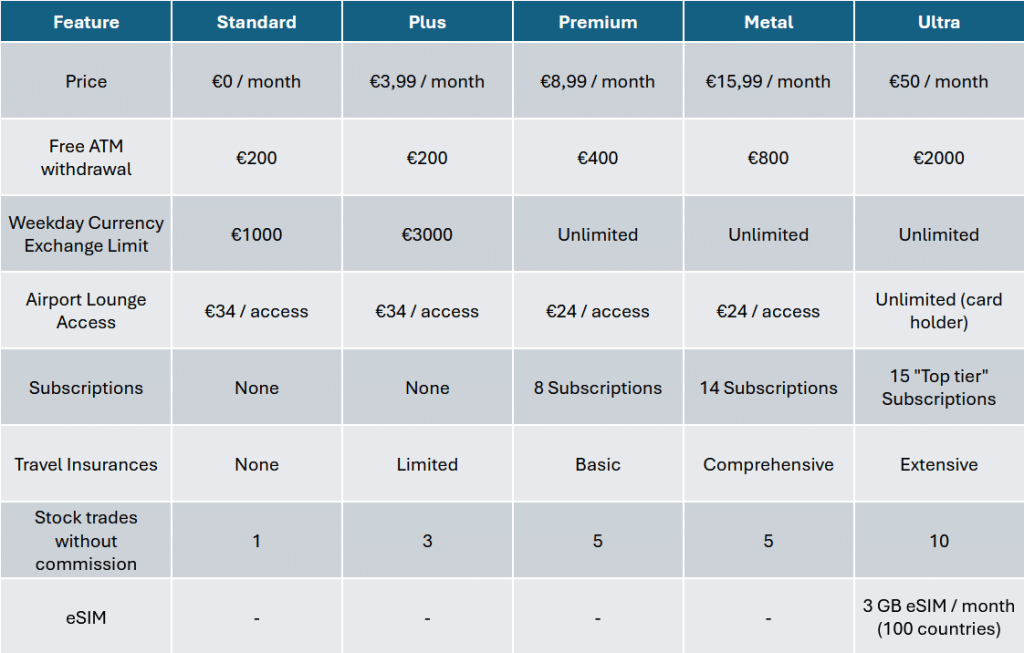

Revolut Plans in Belgium

Below you can find a clear overview of the key features and costs associated with each Revolut plan Belgium:

The included partner subscriptions per plan:

Is Revolut Card Belgium worth it?

The card is fairly new and given the Fintech climate, I am currently awaiting for more experiences. For this particular reason, I decided not to add the credit to my blogposts. For credit cards in Belgium see earning miles credit card Belgium, and how to pick the right credit card in Belgium.

Credit Card Belgium with Airport Lounge Access

For a credit card with a cost of 50 euro per month, I find the Revolut airport lounge access Belgium to be on the conservative side. If you find Airport Lounge Access important, then American Express Platinum Belgium is much more valuable at 65 euro per month. Although it is more expensive than Revolut Ultra plan, you’ll get a PriorityPass that gets you unlimited lounge access, including 1 guest. On top of that, you can request a second card for free with American Express Platinum and the second card holder will also be able to have a PriorityPass with unlimited lounge access and 1 guest.

Fiscality, transaction tax and foreign IBAN accounts with Revolut Belgium

Belgian users must be aware of their fiscal responsibilities stemming from opening and investing with Revolut Belgium.

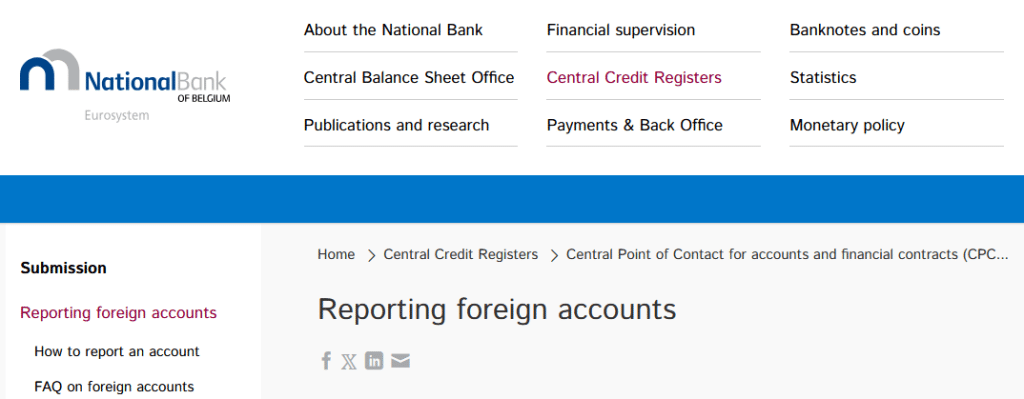

1. Revolut Belgium – Declaring foreign accounts to the National Bank of Belgium (NBB)

A primary obligation for Belgian tax residents is to declare any foreign bank accounts they hold, including their Revolut account. You can complete this declaration through NBB’s web application (cappcc.nbb.be). Currently, Revolut is generating Lithuanian IBAN accounts upon registration, meaning that you’re in obligation to declare this at the NBB. Revolut is currently working on assigning Belgian IBANs so that will remove this administrative burden.

2. Include your Revolut IBAN on the annual Tax Declaration Belgium

In addition to the initial declaration to the NBB, Belgian residents must annually declare their foreign bank accounts, including those with Revolut, on their personal income tax return. Taxpayers typically report this information in Box XIII, section A of the tax form. For each foreign account, they need to specify the account holder’s name and the country where the account was opened; for Revolut, this country is Lithuania. This annual declaration is a recurring obligation that must be fulfilled as long as the account remains open. Even individuals who receive a simplified tax return must still declare their foreign accounts. Revolut is currently working on assigning Belgian IBANs so that will remove this administrative burden.

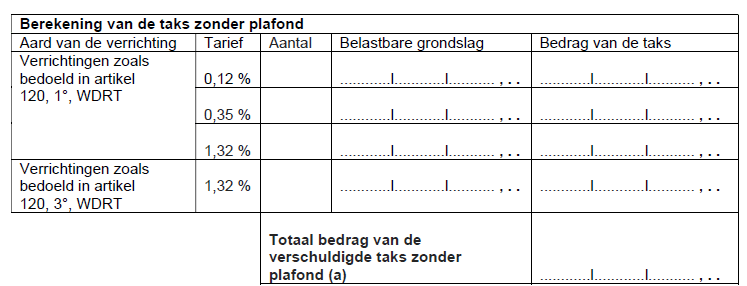

3. Tax on Stock Transactions Revolut Belgium (TOB – Beurstaks)

For Belgian residents who utilize Revolut’s platform for investing in stocks and ETFs, it’s crucial to understand their obligations regarding the Belgian Tax on Stock Transactions (TOB). The TOB is a tax levied on transactions involving both Belgian and foreign securities, and this obligation applies even when these transactions are executed through foreign brokers like Revolut. It’s important to note that while some foreign brokers catering to Belgian residents offer the service of automatically handling the TOB on behalf of their clients , Revolut currently does not provide this functionality. This means that Belgian users who invest through Revolut must be prepared to manage the calculation, declaration, and payment of the TOB themselves, adding an administrative layer to their investment activities.

Stability of Crypto, KYC and Fintech in one product

Alongside positive experiences on the internet, several recurring concerns emerge from Belgian user feedback. One of the most frequently cited issues is the occasional freezing or blocking of accounts related to KYC, sometimes with limited immediate explanation or resolution from customer support. This issue is particularly known for Fintech companies as they do their best to comply to KYC regulations. On another levevel, the fact that Revolut allows Crypto transactions, could also be a challenge if governments decide to crack down on Crypto trading. This makes it a caveat but also a brave step of Revolut to include Crypto in their All-in-One platform.

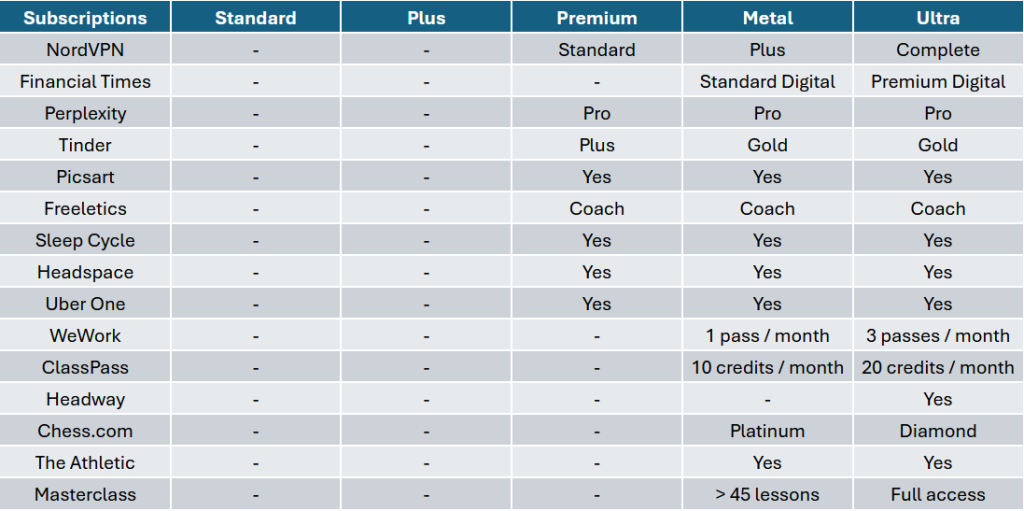

Subscriptions related to the Revolut plans

In my personal eyes, I do see very limited value into all the subscriptions that are offered. Most of them are products I haven’t even heard. Due to the extensive list of included subscriptions, users may become depended to a certain subscription or application. Consequently, if Revolut were to discontinue its partnership with one of the subscription models within the plan, users might find themselves reliant on that particular product, potentially leading them to pay for it – precisely the dynamic such partnerships often aim to create. Ultimately, it seems the software companies stand to gain the most from this arrangement.

Conlusion

While I do love the idea to have an All-in-One financial platform for investing, credit card and travel rewards, I still think Revolut has some work to do. As mentioned in all the paragraphs above, there are some reasons I still stay aside the line before jumping on the wagon. To conclude, I will still do my stock investments on Belgian brokers who do all the administrative work for me, have a travel card with my favourite benefits and own my standard free bank account at a Belgian bank with physical branches.

Are you looking for a great Travel Rewards Credit Card for Belgium? Then I suggest to read my How to pick the right credit card in Belgium guide!

Disclaimer: This post contains invite links. If you choose to register through our link, we may receive benefits; however, the inclusion of these links does not affect the integrity of our content.