The American Express Belgium Platinum card stands out as a distinctive and appealing option in the Belgian credit card landscape. However, the steep annual fees might make you think twice before applying. Are you eager to maximize the benefits of your American Express card, or are you curious about its potential return on investment? If so, keep reading!

Membership Rewards Points

Membership Rewards Points are the unique currency of American Express. You can earn these points primarily through two avenues:

- Sign-up bonus or from refer-a-friend (click here to see the current sign-up bonus)

- For each euro you spend, you accumulate 1 point. It is therefore important to use your Amex card for as much daily expenses as possible.

Points do not expire as long as you maintain an Amex credit card. You can redeem these points for flights, train tickets, hotel stays, gift cards in the Rewardshop, or even to cover your Amex annual fee. American Express values these points at 0,002 euros or 0,2 euro cents each, meaning that 100.000 points equate to 200 euros. However, you can often maximize their value by using them for travel-related purchases which we will list below.

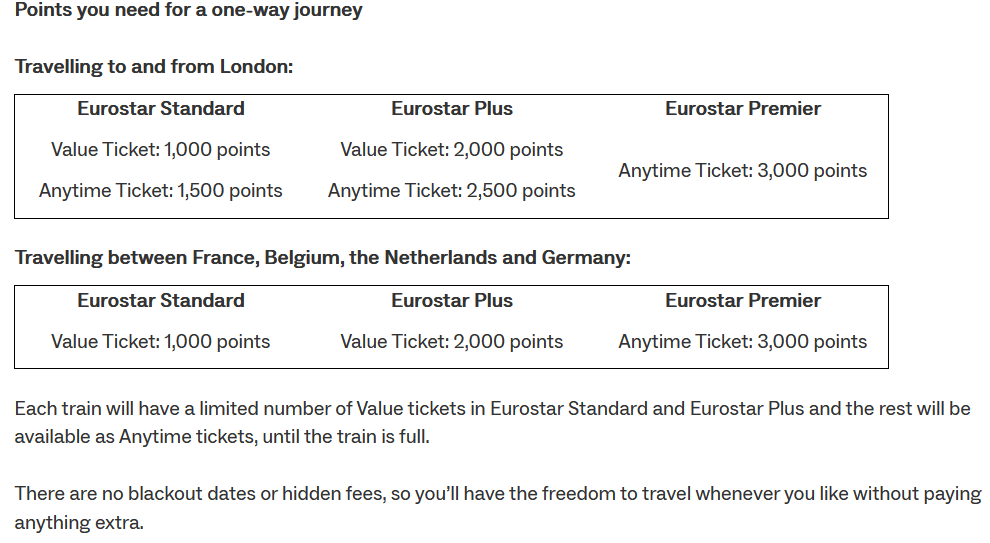

Club Eurostar Points

The conversion rate for Amex points to Club Eurostar Points is 2000:100. If you’re looking to book for example a one-way ticket from Brussels to London, you’ll need either 1.000 Eurostar Points for the first seats or 1.500 for any other available seat. This translates to needing 20.000 or 30.000 Amex points, respectively. A last-minute ticket for this route can easily set you back 189 euros. If you end up needing a last-minute ticket, your Amex points will be worth about 0.6 euro cents each. If you manage to grab a seat for 1.000 Eurostar Points, each point could be valued at 0.9 euro cents!

Hilton Honors & Marriott Bonvoy Points

Amex points can be transferred at a 1:1 ratio. The points can be used to book hotel nights. Many international travel bloggers value these points at around 0,5 euro cents each. However, if you take advantage of the complimentary loyalty programs, the value of your points can significantly increase. As a Platinum cardholder, you automatically receive Hilton Honors & Marriott Gold status, which grants you perks like the 5th night free offer. When you book a 5-night stay with hotel points, you only pay for 4 nights! This effectively raises the value of your points to at least 0,6 euro cents each.

Air miles

American Express Belgium has partnered with 7 frequent flyer programs to allow conversion of your points to miles. 4 of these programs offer a transfer rate of 2:1, meaning you get 1 air mile for every 2 Amex points. The other 3 programs provide a more favourable rate of 3:2, allowing you to earn 2 air miles for every 3 Amex points:

– Miles & More (Star Alliance) (2:1)

– Emirates (2:1)

– Etihad (2:1)

– FlyingBlue (Skyteam) (2:1)

– Delta (Skyteam) (3:2)

– British Airways (OneWorld) (3:2)

– Scandinavian Airlines (Skyteam) (3:2)

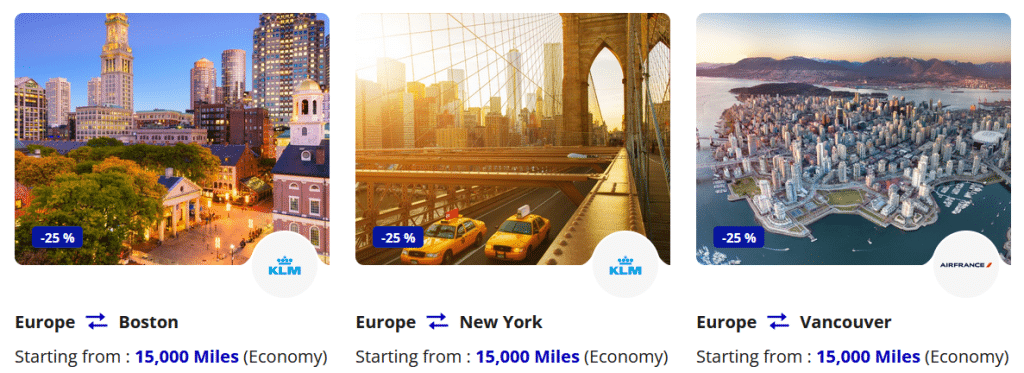

Every program has its unique advantages. It’s a good idea to search for potential deals before moving any points to your favorite program. For instance, FlyingBlue features monthly Promo Rewards, which provide fantastic opportunities to use your miles.

Miles & More features a program known as Mileage Bargains, which allows you to book round-trip flights to Africa for just 40,000 Miles & More miles in business class, or 55,000 miles for business class travel to North America. However, keep in mind that redemptions through Miles & More often come with significant taxes.

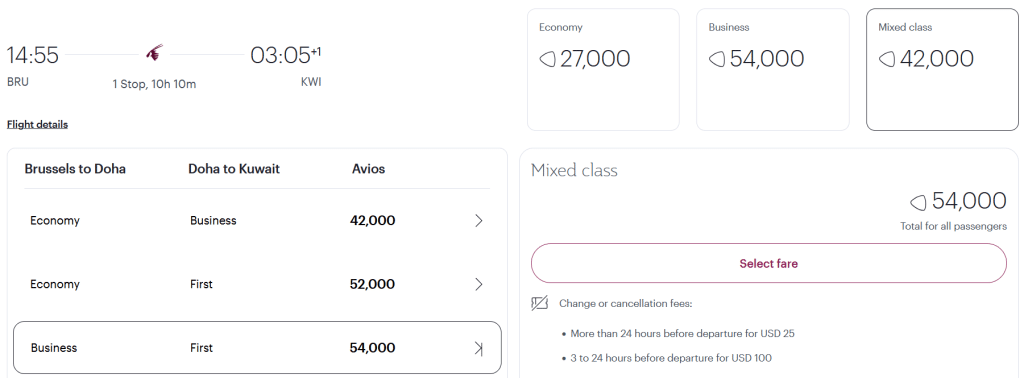

British Airways makes it super easy to connect with OneWorld partners that use Avios as miles. This means you can book rewards on Qatar Airways or Iberia by transferring your Amex points to Avios at British Airways. A great deal with Qatar Airways is flying to the Middle East, where your second leg to a Middle Eastern destination can be booked in first class for the price of a business class reward.

Priority Pass & Fast Lane at Brussels Airport

One of the coolest perks of the Platinum card is that it gives you unlimited access to lounges, plus you can bring a guest along. So, the next time you’re at the airport, you can chill in style. Most lounges around the globe offer free snacks and drinks, including some nice cocktails. You’ll also enjoy free Wi-Fi and comfy seating, and some even have showers! You can check out Prioritypass.com to see which airports offer lounges accessible with Priority Pass. While Brussels Airport isn’t specifically mentioned, you can still access it if you have the Belgian Platinum Card.

With the Belgian Platinum Card, you also get unlimited access to the fast lane at Brussels Airport. This means your time at Brussels Airport will be significantly more enjoyable and stress-free.

Dining Credit

The American Express Belgium Platinum Card provides an annual dining experience worth of 300 euros. You are allowed to eat out for 2 persons three times a year.

Hotel & Car Rental Elite Status

The American Express Belgium Platinum Card provides you with direct access to specific loyalty statuses. These statuses are typically obtained by staying consecutive nights or reaching a certain spending threshold. Here’s a list of the statuses that are included in the Platinum Card:

- Radisson Rewards – Premium

- Hilton Honors – Gold

- MeliaRewards – Gold

- Marriott Bonvoy – Gold Elite

- Hertz – Five Star

- Avis – Presidents Club

Most loyalty programs offer comparable benefits, including guaranteed reservations, complimentary (premium) Wi-Fi, bonus points, late check-out, and occasionally, room upgrades. Below we’ll highlight the key unique benefits:

- Hilton Honors: Enjoy complimentary breakfast and waived resort fees on reward stays.

- Radisson Rewards: Take advantage of the Discount Booster for up to 20% off.

- Hertz & Avis: Benefit from a free additional driver, discounts of up to 15% (Hertz) or 25% (Avis), and car upgrades.

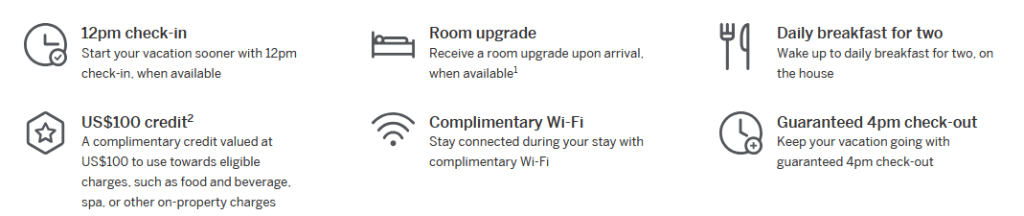

Fine Hotels + Resorts

Are you excited to take your travel adventures to the next level? With American Express Fine Hotels + Resorts, you can enjoy a realm of exclusive benefits and tailored services that transform luxury. Book at least for 2 nights and enjoy the guaranteed benefits by American Express.

2nd Platinum card for free

Requesting a second Platinum Card is essential, as it’s included. The additional cardholder can take advantage of numerous perks, including Priority Pass, Fast Lane access, and complimentary loyalty program statuses. This secondary cardholder will have their own Priority Pass membership and can also bring a guest into the lounge.

Be insured by American Express Belgium

The insurance benefits associated with the American Express Belgium Platinum card are among the most comprehensive in the market. Below is a brief overview. For detailed product information, please click here.

- Rental car insurance: Covers repair costs and deductible up to 75.000 euros.

- Missed connection: Provides up to 200 euros per person, with a maximum of 400 euros per trip for accommodation, meals, and beverages if a delay exceeds 4 hours.

- Trip cancellation: Offers coverage of up to 10.000 euros per person or family in the event of a necessary cancellation.

- Ticket rebooking: In cases of delays over 4 hours, overbooked flights, or missed connections, coverage is available up to 4.000 euros per family.

- Accident insurance: Provides up to 500.000 euros in the event of an accident while using public transport.

- Delayed luggage: If your luggage is delayed for more than 4 hours, you can purchase essentials up to 400 euros. If the delay lasts 48 hours or more, this limit increases to 1.050 euros.

- Luggage insurance: In the unfortunate event of loss, damage, or theft, you may claim up to 1.500 euros.

- Purchase protection, Refund Protection, and Satisfaction guarantee: Offers up to 10.000 euros for theft within 90 days of purchase and up to 300 euros for the Satisfaction guarantee.

- Travel and medical insurance: Covers medical expenses incurred abroad up to 3.000.000 euros.

- Travel insurance for winter sports: Provides coverage for costs up to 5.000 euros.

- Locksmith insurance: Offers coverage of up to 100 euros for lost or stolen keys through American Express.

As credit cards allow borrowing money please note that borrowing money also costs money.

For full disclosure of the credit card conditions, please visit the official website of the credit card issuer.

Read the agreement before signing up to any credit card.