I often get the question how I afford my travel habits and have the luxury travel on a budget. I wrote this article to explain my personal experience as a Belgian with hotel and airline loyalty programs, credit cards, cash-backs and great travel deals. If you’re a beginner in travel hacking or want to know more about my experiences, read on!

1. Frequent flyer programs

A. Earn miles & spend miles

A lot of people recommend a random frequent flyer program to individuals when they book a flight with that airline. However, choosing the right frequent flyer program is crucial when starting out the points and miles game. Brussels Airlines, the main carrier of Belgium, frequently advertises the Miles & More program, which is why most Belgians opt to join it. Miles & More is a good program but your miles will expire within 36 months. If you don’t accumulate enough miles to actually use them, you might end up losing your earned miles due to expiry.

Choosing the right loyalty program

Miles & More however is an interesting frequent flyer program if you own one of their credit cards as they prevent your miles to expire as long as you use the card. I have an extended post about choosing the right frequent flyer program for Belgians but also how you can earn miles through credit cards as a Belgian. The most interesting being American Express who runs promotions frequently, especially if you try to do all your spending as much as possible with American Express. This will boost your earnings and return of investment.

Long haul business class cabin with LATAM Airlines I booked with Miles & More miles

You can use your earned award miles for various purposes like hotel stays, shopping, and car rentals, but the best value comes from booking flights. Opting for business or first class can be particularly rewarding, as you only need to cover taxes and fees. For instance, a flight from Frankfurt to Singapore in economy might incur over €250 in taxes, which is nearly the cost of an economy ticket. However, €250 is a fantastic deal for a business class ticket and an incredible bargain for first class. Some airlines, such as Singapore Airlines, Air India, Thai Airways, and Ethiopian Airlines, are known for their lower taxes and fees, so consider them to save money on taxes. Business class is especially advantageous for long-haul journeys, offering lie-flat seats that allow you to rest, enjoy meals, and arrive at your destination feeling refreshed.

My starter on a Brussels Airlines flight to FNA (Freetown) in Business Class

B. Travel in comfort with your airline status

A frequent flyer status with your favourite alliance can give you great advantages. The greatest benefit is definitely lounge access. A gold status allows you to invite one additional guest to the lounge. Getting a status is generally not very easy, but with some tricks it might be much easier than some people think. I chose Miles+Bonus as it is the easiest program to get a Gold status for me. Flying 4 times with Aegean Airlines each year lowers the threshold by half to attain and retain the status. I have written an extended post about the best ways to get frequent flyer status as a Belgian, however my list is not exhaustive.

The bar at The Loft by Brussels Airlines – Free drinks and food in the lounge!

The bar at The Loft by Brussels Airlines – Free drinks and food in the lounge!

Lounge access is not the only perk of being a gold status holder. I can use priority check-in, fast lane at the security and enjoy priority boarding. Altogether these benefits make air travel less stressful and the time you need from the check-in desk to the gate reduces tremendously.

If your flight is overbooked, you are guaranteed a seat at the plane as a gold status holder. If you’re lucky, you might even get a free upgrade to premium economy, business or first class because gold members are the first in line to get an operational upgrade.

Operational upgrade with Ethiopian Airlines business class. Lie-flat seats so I can sleep during the flight, for the price of economy!

2. Hotel Loyalty Programs

Staying loyal to a certain hotel chain can give you a lot of benefits. There are many options on the market but the main hotel chains are Hilton Honors, Marriott Bonvoy and IHG (InterContinental Hotels Group). I have made an extensive post about hotel loyalty programs for beginners. My go-to hotel chain is IHG, as I have the highest status with them as long as I refresh my paid-to-have Ambassador status. I have tried different hotel chains by using status matches so I can enjoy benefits over multiple hotel chains without having to stay 75 nights a year in hotels. All this is well explained in the linked post I have mentioned above.

IHG Ambassador status

My way to maximize my IHG Ambassador status is by booking a room with lounge access. With the annual weekend certificate I can book a weekend trip for two nights for the price of one. The lounge access gives me access to breakfast in the morning and hors-d’oeuvre or canapés with (alcoholic) drinks in the evening. This is a perfect way to enjoy a luxury get-away.

InterContinental Berlin – Club Lounge drinks selection during the evening

InterContinental Berlin – Club Lounge drinks selection during the evening

The ambassador status also gives me a room upgrade to the next available room type on my InterContinental stays. For example, I booked the basic room in Geneva and my hotel status got me upgraded to a suite with amazing lake view.

InterContinental Geneva ambassador upgrade to a suite with lake view and welcome amenities

While enjoying all those benefits you will also earn hotel points. Those award points can be used just like air miles for shopping, flights and free hotel nights. You can get the best value for your hotel points by booking free hotel nights. Hotel points are extremely valuable as they get you free nights without any additional costs except the occasional city tax of a few euros. For example, I used a part of my points for a booking of 3 nights at the luxurious InterContinental Danang Resort.

InterContinental Danang Resort with large bathroom and huge private terrace on points

3. Get the most for every euro you spend in life

Air miles are accumulated through flights, while hotel points come from your stays at hotels. You can also earn points on all your purchases, travel-related or not, by using credit cards. By adjusting your daily spending habits, you can significantly enhance your travel experiences. It’s beneficial to use your points-earning credit card for everyday expenses like shopping, gas, and travel bookings. If you’re making large purchases, such as furniture for the first time, having a points-earning credit card is essential. To maximize your returns on every euro spent, consider using online cashback sites to receive a percentage back. For instance, MobileVikings offers Viking Deals that provide cashback in mobile credit, while other platforms let you cash out your earnings. For more information on cashback websites, look into my post on how to save money.

my quick personal guide when I spend money in daily life

- Compare prices online until you find the cheapest offer

- Look if the website accepts Paypal, American Express or Mastercard to earn points or miles

- Check if the website is mentioned on any cashback platform (Topcashback, Shopbuddies, cashbackxl.nl or Mobile Vikings)

- Make the purchase.

- If a points-earning credit card is not accepted as payment option, find a loophole: for example buying Ikea gift cards in Carrefour to use in Ikea when American Express was not accepted in Ikea.

Result: paid the lowest price for the product, earned points during the transaction and received a cashback on the purchase. A win-win-win.

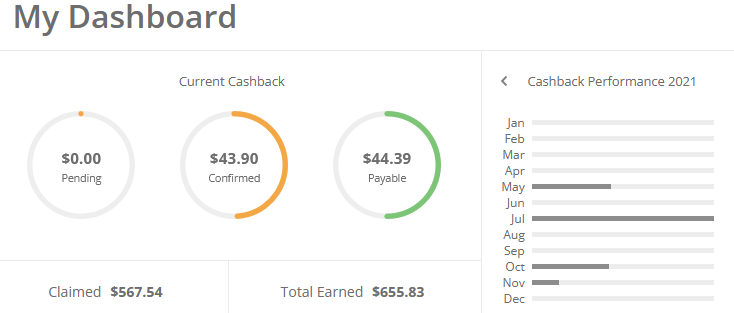

My personal cashbacks from the cashback platform Topcashback.com

my quick personal guide when I book a flight

- look for the cheapest flight that fits my travel plans (see how to book cheap flights)

- earn miles through flying according to one of the frequent flyer programs

- pay the ticket with a credit card that earns me miles or points

- use a cashback website to earn back money whenever possible

I have covered the basic topics about maximizing your travel budget for luxury travel in this post and linked to several other posts on my blog. Make sure to read all the details before enrolling into something. Credit cards are a great way to earn points & miles but they require financial planning as you will have to pay your expenses weeks after the actual spending. You will also need a minimum amount of spending to profit from those credit cards as you have to pay annual fees. Some topics I covered are linked to additional expenses, such as the Ambassador status at IHG Hotels. If you plan wisely and inform yourself about the IHG program and Ambassador status and ways to maximize the use of the status, you can benefit a lot from it.

Spend, but spend smart.

4. Scout the internet on a regular basis for exceptional deals

Taking the time to look for great deals on a regular basis can be extremely rewarding. I made it easier for you by creating posts about how to book cheap flights and how to book cheap hotels.

One of my most valuable experiences I managed to book was an exceptional deal, where a great fare was bookable from Düsseldorf to Madrid with various stopovers in business class. During that time, a Cessna Citation jet was flying twice weekly from Düsseldorf to Luxemburg, which could be incorporated into this booking. I managed to book a ticket during low season and was able to have a private jet experience, including two business class flights all for about 160 US dollars!

Disclaimer: This post may include referral links to websites. If you choose to register through our link, we may receive benefits; however, the inclusion of these links does not affect the integrity of our content.