Earning air miles goes beyond just flying. You can accumulate air miles by using your credit card or by converting credit card points into miles. Signing up for a card often comes with a sign-up bonus, and you can earn additional miles based on your spending. The earning rate typically ranges from 1 to 2 miles or points for every euro spent. I’ll walk you through the limited Credit Cards in Belgium.

American Express Gold & Platinum Credit cards

If we are looking at the credits cards available in Belgium, American Express comes up as one of the first recommendations. With the American Express Gold & Platinum you can earn Membership Rewards points. By using an invite link you can earn a generous sign-up bonus. Click here to see the current American Express sign-up promotion.

Membership Rewards points can be transferred to a handful of partners:

How to interpret the table above?

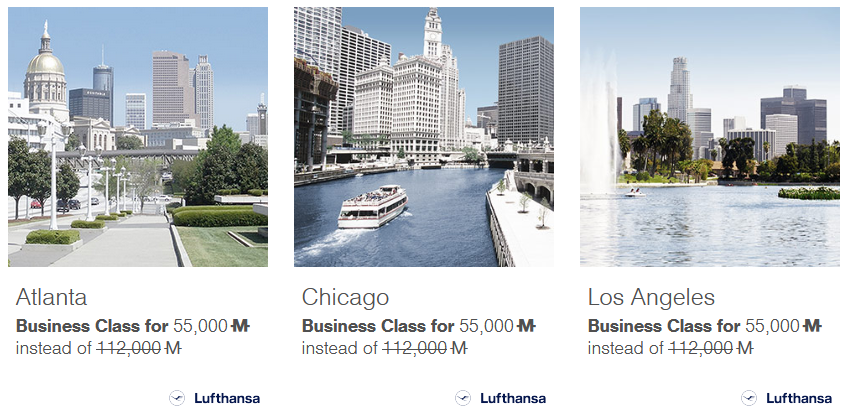

Let’s say you have accumulated 110.000 Membership Rewards points, you can convert them to 55.000 Miles & More miles. By keeping an eye on the monthly Mileage Bargains, you might find a great deal for a round-trip business class ticket to North America. Additionally, trips to Africa can occasionally be booked for as little as 40,000 Miles & More miles. Just keep in mind that you’ll need to cover taxes, which can be quite steep with the Lufthansa Group, ranging from 300 to 500 euros for a long-haul return in business class.

Examples of Mileage Bargains of 2024

So what’s the difference between the American Express Gold and the Platinum besides the hefty annual fee (240 euro vs 780 euro)?

Both cards offer extra’s and depending on your lifestyle and travel habits, it might be useful to choose for the Platinum card. I have a dedicated post about how to maximize the Belgian American Express Platinum Card.

Platinum card benefits vs Gold card

- Annual dining credit (3 times eating out for 2 for Platinum vs 100 euro for Gold)

- Free hotel statuses (MeliaRewards, HiltonHonors, Marriott Bonvoy and Radisson) for Platinum only

- PriorityPass unlimited + invite one guest for Platinum vs 4 passes each year with Gold

- Unlimited fast lane access at Brussels Airport for Platinum

- A free Platinum card for your partner or friend which also gets PriorityPass unlimited

- More insurance coverage and extra coverages

Your travel habits and lifestyle play a significant role in determining the value of the benefits mentioned. For instance, if you already have airline status, the PriorityPass may not hold much value for you as a perk.

Personally, I assess Membership Rewards points at about 0.6 eurocent each, given the unfavourable conversion rates for Belgians (like 2 points equating to 1 Miles & More mile). By applying this valuation and considering your annual spending, you can estimate the points you’ll accumulate with your card, helping you decide if the card and its annual fee are worthwhile.

Business class starter on Brussels Airlines – Long haul flight

The most effective way to get the most out of your points or miles is by using them for business or first-class flights. While loyalty programs may promote spending your miles on shopping, hotel stays, or other options, these alternatives typically don’t offer the same value as booking a business class ticket.

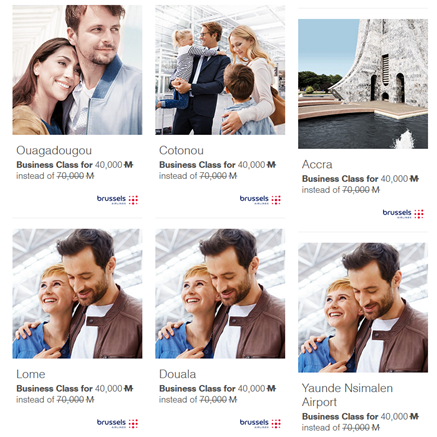

Beobank Brussels Airlines Mastercards

Since 2025, a new Mastercard was released that is linked to Miles & More, a Lufthansa Group frequent flyer program.

Click here to see the offer in Dutch on the official site of Beobank.

The offers are great, especially if you regularly book flights with Brussels Airlines or Star Alliance partners. The amount offered in miles for the Explore card is very limited, as all expenses will only net you 0,5 miles per euro. If you own the Altitude card and consider Miles & More miles to be worth 1c per mile, you’ll be able to break-even with 14400 euro annual spend. If you fly Brussels Airlines, you’ll be able to earn more miles and be able to use Lounge vouchers, which will bring your break-even point much lower.

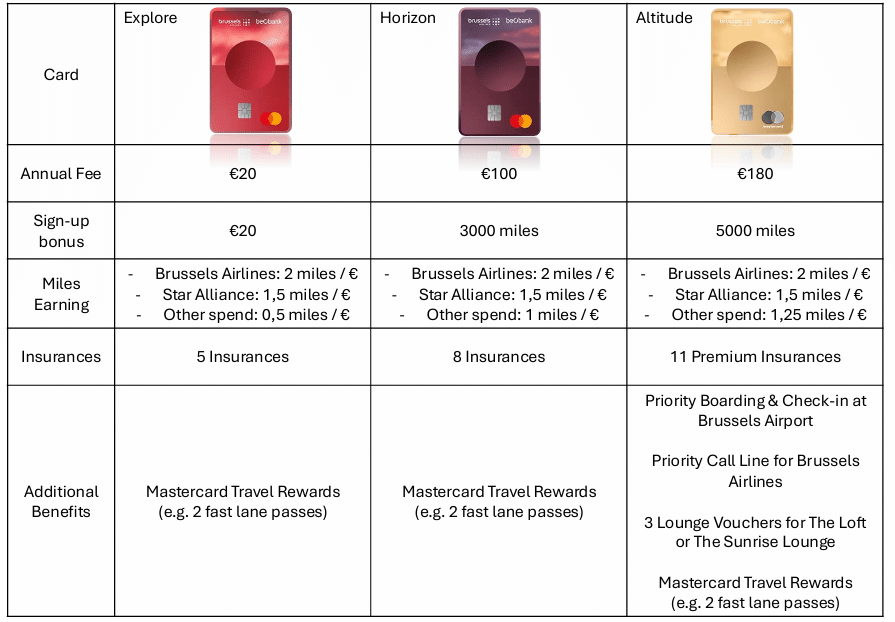

Beobank Flying Blue Mastercards

Flying Blue is the frequent flyer program associated with the Skyteam alliance, which includes airlines like KLM, Air France, and Delta, among others. By using Flying Blue cards, you can earn air miles that can be redeemed with Skyteam partners.

The sign-up bonus for the Flying Blue World MasterCard varies, typically offering around 3500 miles, while the Premium card often provides about 5000 miles. With the Premium card, you earn 1,25 miles for every euro spent in Flying Blue miles.

Business class lunch on ITA Airways (SkyTeam member) – Intra-European flight

The card provides travel insurance options akin to those found with American Express, albeit with lower coverage limits. However, American Express includes additional insurance features, like coverage for medical expenses, that are not available with Flying Blue cards.

When weighing the benefits of Mastercards against American Express, it’s important to note that MasterCard tends to have broader acceptance in Belgium which makes it a very viable option if we look to the available credit cards in Belgium.

Conclusion for Beobank Flyingblue Mastercard

Beobank cards are convenient for those who want a card that is accepted almost everywhere, thanks to MasterCard’s broad reach in Belgium. However, the sign-up bonus offered by Beobank is relatively modest, which means it may take a while to accumulate enough miles for your first complimentary flight.

When we calculate the value of 1 Flying Blue mile at 0.01 euro each, it turns out you would need to spend 12,000 euros annually with your Beobank card to reach a break-even point. This suggests that earning miles through Beobank offers a better return on investment than American Express Membership Rewards. However, due to the lower sign-up bonus and lack of additional benefits with Beobank, I believe American Express provides a superior return on investment, though it ultimately depends on your personal spending habits and lifestyle.

Non-Mileage Earning Beobank Mastercards

Beobank offers a diverse range of credit cards in Belgium. Instead of covering every option, we’ll concentrate on the cards that are really worth to discuss.

Smart & Elite Travel Mastercard

The two cards appear quite alike, yet the Smart Travel card operates on a points system, whereas the Elite Travel card is based on miles.

Smart Travel key points:

- 30 euro annual fee

- Capped at 250 euro savings per year (equals to 25.000 points)

- 1 eurocent cashback per 2 euro spend (= 0,5% cashback)

Elite Travel key points:

- 60 euro annual fee

- Capped at 450 euro savings per year (equals to 45.000 miles)

- 1 eurocent cashback per 1 euro spend (= 1% cashback)

While neither card is associated with a frequent flyer program, it’s important to note that the miles or points they offer have a set value, leaving no opportunity for maximizing returns like with the Flyingblue Mastercard, which allows for promotional offers to enhance your mileage investment. Furthermore, we prefer cards without spending limits. Even if you believe you won’t hit a cap, life can bring unexpected expenses, and in those situations you don’t want to have a capped credit card.

Beobank Extra Mastercard

Finally, one of last potential appealing credit cards in Belgium is the Extra Mastercard. This cashback card provides 1% back on all purchases and has a low annual fee of just 20 euros. However, it’s important to note that there is a cap on the cashback you can earn, limited to 100 euros per year. This means that if your spending exceeds 10.000 euros annually, you won’t receive any additional cashback.

As credit cards allow borrowing money please note that borrowing money also costs money.

For full disclosure of the credit card conditions, please visit the official website of the credit card issuer.

Read the agreement before signing up to any credit card.