This article will guide you on how to save money by utilizing cashback platforms and Belgian credit card benefits. Understanding the ins and outs of these financial tools can lead to significant savings over time. I’ll list a few tips and tricks including examples with my personal experience.

Purchase everything with a credit card

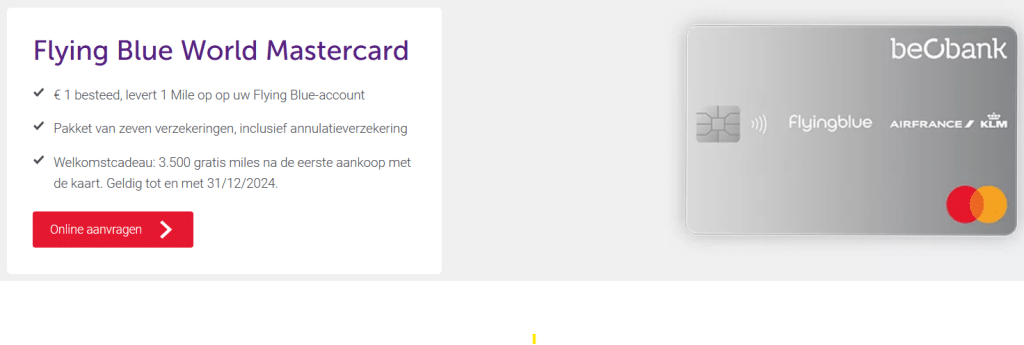

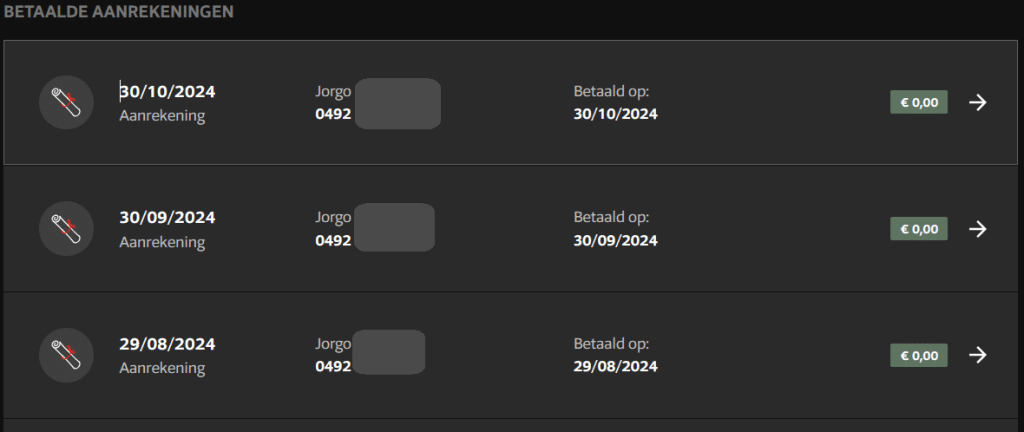

Belgian Credit cards provide an excellent opportunity to earn cashback, points, or miles with every purchase.

Why you should use a credit card over a debit card:

- Earn points or cashback for every euro spent, usable with your credit card. Explore Belgian credit card options here.

- In case of fraud or service issues, you can easily request a chargeback, unlike with debit cards.

- Enjoy protection from included insurance, from travel coverage to purchase protection, based on your Belgian credit card.

- Maximize rewards with sign-up bonuses and dining credits; check current offers for American Express cards here.

Some credit cards come with a hefty annual fee, but you can easily assess their value by looking at the benefits that matter to you. For instance, if you consider the miles earned with a card to be worth 1 eurocent each and the annual fee is 75 euros, you would need to spend at least 7500 euros annually on that card to cover the fee. Any spending beyond that point is essentially profit. This example calculation doesn’t factor in other potential benefits such as sign-up bonuses or included insurance protection.

Tips to increase your daily expenses on your Belgian credit card:

- Connect your monthly or annual subscriptions like Spotify and Netflix to your credit card.

- Use your credit card for all daily purchases, from gas to groceries.

- Be the first to swipe your card when dining out with friends when splitting the bill.

- Offer to do the family’s purchases of significant cost with your credit card.

Look for cashback opportunities

When you’re shopping or making hotel and flight reservations, keep an eye out for cashback options. It’s an easy and rewarding way to get some of your money back on your purchases.

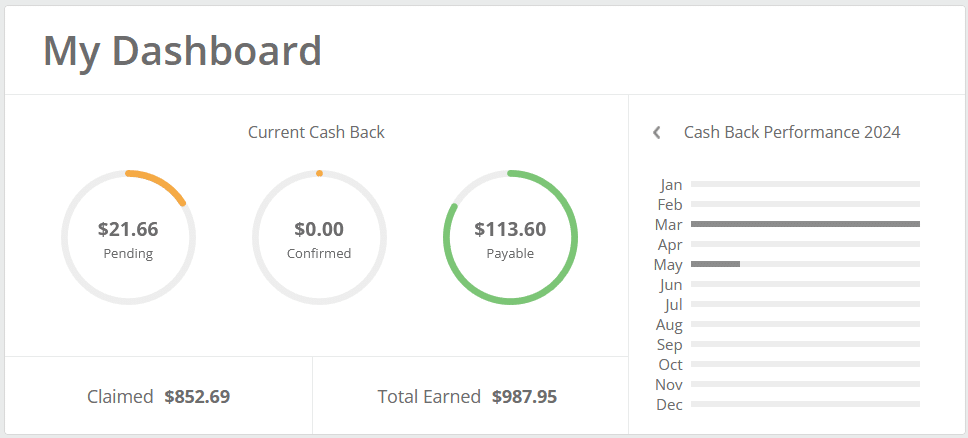

- Utilize cashback platforms to receive a portion of your spending back, redeemable via Visa prepaid cards, PayPal, or direct bank transfers. I mainly use topcashback.com for hotel and airline bookings, cashbackxl.nl and shopbuddies.be for Belgian/Dutch online webshops.

- For Star Alliance Gold status chasers with Aegean Airlines, consider Apopou.gr for cashback opportunities.

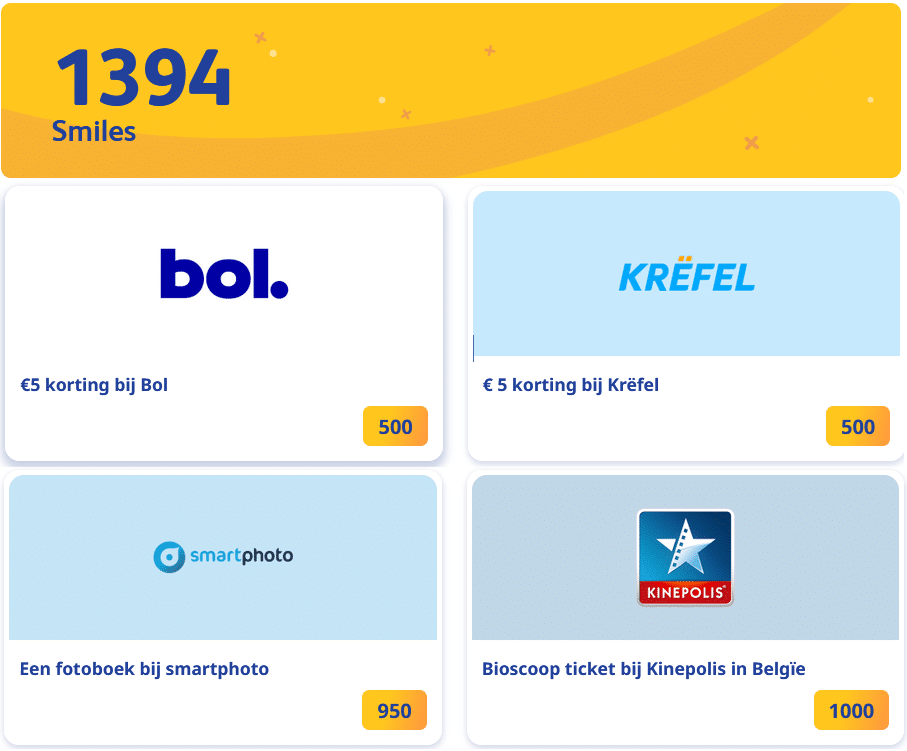

- If you are a Mobile Vikings client, take advantage of Viking Deals to earn cashback that can be used for your mobile subscription.

Earn points or miles by signing up to loyalty programs

One effective way to enhance your earnings is by enrolling in loyalty programs. For instance, if you frequently refuel at Q8 because it’s the most affordable option in your vicinity, it makes perfect sense to join their loyalty program. By doing so, you can accumulate points that can later be redeemed for various rewards, including free services or discounts. Similarly, many supermarkets, like Delhaize and Carrefour, have their own points systems that allow you to earn rewards on your grocery purchases, making it a smart choice to take advantage of these offers.

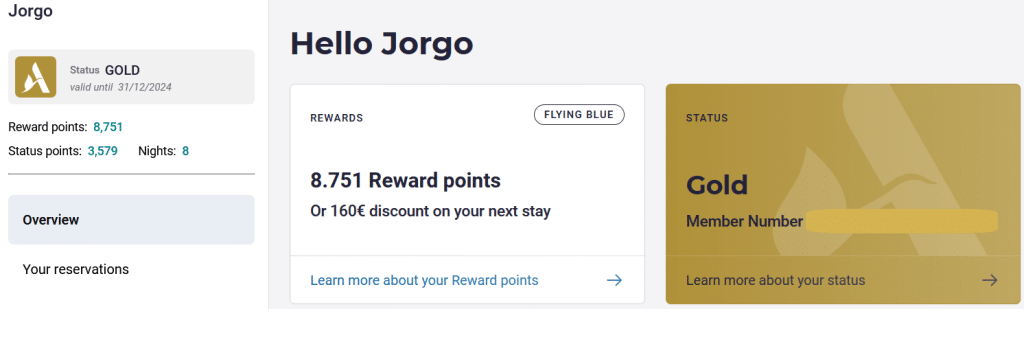

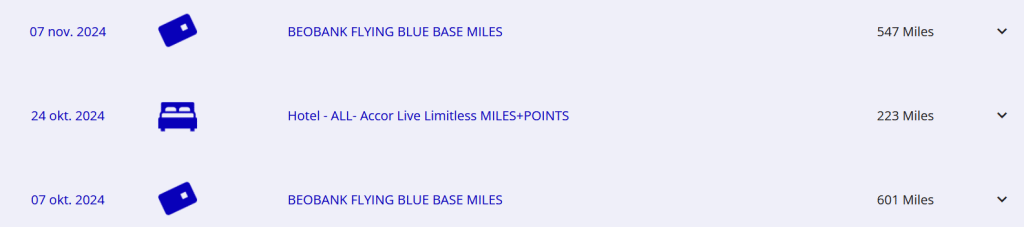

The same principle holds true for travel, particularly with airlines and hotels. If you often fly with Brussels Airlines, consider signing up for the Miles & More frequent flyer program. This way, you can accumulate miles that could eventually lead to a complimentary flight. Additionally, numerous hotel chains provide loyalty programs that reward you for your stays. Click here to read more about hotel loyalty programs. By leveraging these programs, you can maximize your travel and accommodation experiences while enjoying the benefits of your loyalty.

Compare prices

It’s important to ensure you’re truly scoring a great deal when shopping online. When browsing sites like Bol.com or Amazon.com.be, you might stumble upon products that are priced way higher than they should be. Some sellers have figured out how to profit by inflating prices on these platforms, so it’s crucial to be savvy and do your research. Take advantage of the internet to compare prices across different sites and make sure you’re not overpaying for something that should be more affordable.

The same principle applies when booking flights and hotels. Instead of limiting yourself to just one airline’s website, why not check out Google Flights? It can quickly show you a range of flight options in just a few seconds, making it super easy to find the best deal. Similarly, Google Hotel Search allows for straightforward comparisons of hotel prices. If you’re looking for more tips, be sure to check out my articles on “How to book cheap hotels” and “How to book cheap flights” for some great advice on saving money while travelling.

Start Double-dipping

You made it to the end of my post – way to go! In the world of frequent travel, it’s pretty common to mix and match strategies like the ones I just shared. This approach is often referred to as double-dipping.

Example 1

For instance, let’s say you’re gearing up for a family vacation in Mexico and have your sights set on a Marriott Resort in Cancun. You check out your go-to cashback sites and discover that topcashback.com is offering a sweet 6% cashback deal. Plus, since you’re a Marriott Gold Elite member thanks to your American Express Card, you’re in for some extra perks. When you book your hotel through the topcashback.com link, you snag that 6% rebate, and on top of that, you’ll rack up Marriott points as a loyal member. Those points can come in handy for a free stay on your next visit if you accumulate enough. And don’t forget, you’ll also be earning American rewards points for every euro you spend, making this trip even more rewarding.

Example 2

Now, let’s look at another scenario. You’re in the market for a MacBook and find that Mobile Vikings is offering a 3% cashback at Mediamarkt, which happens to have the best price for the laptop you want. As a new holder of an American Express Gold Card, you’re also eyeing that enticing sign-up bonus of 60.000 points if you spend 2500 euros within the first three months. So, you go ahead and purchase the MacBook for 2500 euros through the Mobile Vikings Cashback Platform (Viking Deals). This move earns you 75 Vikings Points, which can get you five months of free subscription if your monthly cost is 15 euros (1 Viking Point = 1 euro). Plus, you hit the threshold for that American Express Gold card sign-up bonus, netting you those 60.000 Membership Rewards points. On top of all that, your purchase is protected by your card’s insurance. You’ve now earned points with both your telecom provider and American Express.

Disclaimer: This post contains referral links. If you choose to register through our link, we may receive benefits; however, the inclusion of these links does not affect the integrity of our content.

As credit cards allow borrowing money please note that borrowing money also costs money.

For full disclosure of the credit card conditions, please visit the official website of the credit card issuer.

Read the agreement before signing up to any credit card.