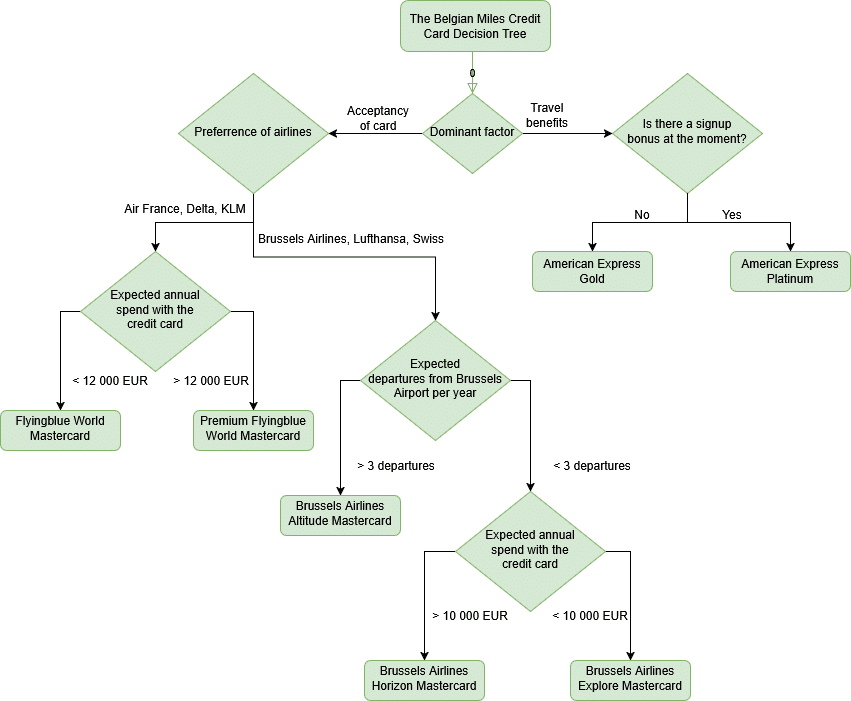

Always wondered how to select the right Travel Credit Card in Belgium where you can earn miles or points? Feeling a bit puzzled with the available options? We’ve looked at some of the most interesting travel credit cards available in Belgium – both Mastercards and American Express cards. Our flowchart will make it super easy to see which card might be the best fit for your travel style and spending habits. This post is a great start for newcomers to travel hacking!

Are you ready to level up your travel game? Let’s dive in and find your perfect travel credit card! Keep on reading if you’re curious based on what info we have created this decision tree.

Breakdown how we built this flowchart

One of the first things that should cross your mind: Are travel benefits more important to you or the acceptancy factor of your credit card? American Express is a great card for travel rewards but it is not accepted everywhere as a payment. Therefore, it is the first question you’ll ask yourself.

American Express path

American Express often runs sign-up bonuses of up to 150.000 points for Platinum cards. If such promo is running, it is a no-brainer to choose this travel credit card in Belgium, as the sign-up bonus itself is worth at least one business class flight. The Platinum card also comes with great travel perks such as:

- Dining credit worth of 300 euro

- PriorityPass with lounge access + 1 guests, also included for the extra Platinum card holder

- Fast lane access in Brussels Airport

- Free hotel statuses (Hilton, Marriott, …) giving you elite status benefits

You can check here which sign-up bonus is currently running. However, due to the high annual fee of this card, you’ll need to maximize the benefits of the Platinum card as much as possible. If the high annual fee is a deal-breaker, you can alternatively take a look at the benefits of the Gold card or check the Mastercard path.

If you’ve landed in the American Express path it is because either you find the Platinum annual fee expensive or there is no generous sign-up bonus running at the current moment. However, even though there is no generous bonus offering running, it could still be interesting to sign up for the Gold card. Why? Because American Express often runs promotions to allow Gold card holders to upgrade to Platinum and earn 150.000 bonus points. Read more about the Gold card benefits of American Express and how you can maximize your points earnings.

Mastercard path

This path allows you to make a decision between the five miles-earning travel credit card in Belgium that exist in Belgium. All of them are in partnership with Beobank and they’re mainly focused over two frequent flyer programs: Star Alliance and Skyteam. While Brussels Airlines is Star Alliance and is part of Miles & More frequent flyer program, it would make sense to choose one of the three Brussels Airlines card if your preference goes to that airline. On the other hand, Flyingblue, is the frequent flyer program that consists of Air France and KLM and is part of the Skyteam alliance. By choosing KLM / Air France or any other Skyteam partner, it would make sense to earn miles within a Skyteam frequent flyer program.

Now, if you’ve landed in the Brussels Airlines credit cards list, we decided to make a breakdown based on your departures from Brussels Airport. Why? Because one of the cards offers very nice travel perks such as lounge access to The Loft, priority check-in and boarding as well as a dedicated phoneline.

Whether you’ve landed at the last step at Flyingblue Mastercards or Brussels Airlines Mastercards, both of the last questions are related to your annual spend you’ll plan to do with your card. As I’ve written in one of my other blog posts, it can be very beneficial to try and move all your daily spendings to a credit card to maximize mileage or points earning. The tresholds to decide which card you should select are simply based on the annual fee of the card and the average value of each mile (a Flyingblue or a Miles & More mile), which is around 1 eurocent per mile. You’ll find the breakdown below.

Breakdown of Mastercards

- Premium Flyingblue World Mastercard:

- Annual fee = €150

- Earn miles per euro = 1,25

- Break-even spend point = 12 000 euro per year

- Flyingblue World Mastercard

- Annual fee = €75

- Earn miles per euro = 1

- Break-even spend point = 7500 euro per year

- Brussels Airlines Altitude Mastercard

- Annual fee = €180

- Earn miles per euro = 1,25 (2 or 1,5 for certain airline purchases)

- Break-even spend point = 14 400 euro per year

- Note: other benefits are not taken into account

- Brussels Airlines Horizon Mastercard

- Annual fee = €100

- Earn miles per euro = 1 (2 or 1,5 for certain airline purchases)

- Break-even spend point = 10 000 euro per year

- Brussels Airlines Explore Mastercard

- Annual fee = €20

- Earn miles per euro = 0,5 (2 or 1,5 for certain airline purchases)

- Break-even spend point = 4000 euro per year

Would you like to see a whole comparison of the Brussels Airlines Mastercards? Then check out my blogpost about the release of the new cards.

Some may be still search for the miles and more credit card Belgium, but this card is unfortunately removed since summer of 2024. Therefore, you will not find it in the flow chart.